This chapter contains the following topic:

Introduction to Fully Paid Open Items

The Fully paid open items selection is how you indicate to the system that you consider certain open items to be fully paid. Future activity for these transactions is not expected. If any occurs (for instance, when a customer unexpectedly pays a debt you had written off), it is considered a new transaction.

Running this selection:

| • | Purges fully paid documents from A/R Open Items. A report of the purged documents is printed. |

| • | Prints the report only, without any purge. This is sometimes a useful preliminary to a purge; it allows you to gauge the effect of any particular cutoff date (or other criterion), with no risk of losing information if you turn out to have misjudged the date. |

| • | Calculates commissions for sales representatives, if commissions are based on payments rather than on sales. |

| • | Optionally transfers purged items to customer history for archival storage. |

You should always print customer statements before you run this selection. Otherwise, the statements may not show all the transactions that occurred since the last statement was printed.

What happens to purged entries ?

If you chose in Control information not to keep customer history, purged documents are deleted from the system altogether.

If you did choose to keep customer history, documents purged from Open Items are transferred to Customer History. There they may be viewed or printed, as described in the Customer History chapter, until that data in its turn is purged.

Balance forward and open item customers are purged differently.

For a balance forward customer with a debit balance as of the cut-off date (the usual case):

| • | All credits through the cut-off date are purged. |

| • | Debits are purged only up to the point where the value of the debits purged is equal to or greater than the value of the credits purged. |

| • | A new balance forward record is then created in an amount equal to the sum of the credits and debits that were purged. Any other debits not paid off by credits remain. |

For example, suppose you have the following documents on file for a balance forward customer:

|

Doc # |

Doc Date |

Amount |

|

111 |

2/01/14 |

100.00 |

|

201 |

2/25/14 |

200.00 |

|

225 |

3/10/14 |

75.00 |

|

316 |

3/15/14 |

225.00CR |

|

375 |

4/10/14 |

150.00CR |

You decide to purge data through 3/31/14. This customer has a debit balance as of this date of $150.00.

These actions occur:

| • | The software deletes document #111 and document #201. |

| • | After the deletion of #201, the value of the documents deleted will exceed the value of credits on or before 3/31/14, so a balance forward record with an amount of $75.00 will be created. $75.00 is the difference between the debits ($300.00) and the credits ($225.00) dated on or before 3/31/14. |

| • | After creating this balance forward record, the software will continue purging credits within the cut-off date, so document #316 will be purged. |

Notice that document #225 will remain just as it is. Once the purge is complete, the following documents will be on file:

|

Doc # |

Doc Date |

Amount |

|

Created by software 2/25/16 |

75.00 (software created balance forward) |

|

|

225 |

3/10/16 |

75.00 |

|

375 |

4/10/16 |

150.00CR |

For balance forward customers with a credit balance (payments and credits exceed charges) a similar process occurs, except that all debits are purged and credits are purged only until the amount of the credits purged is equal to or greater than the amount of the debits purged.

This method of purging balance forward customers allows the detail of long outstanding charges for inactive customers to remain, thereby making collections easier.

If commissions are being paid on payments (as specified in the Commissions paid on field from A/R Control information

), then commissions due to sales reps are calculated for the open items that are purged. Since commissions are only paid on fully paid open items, when the balance forward document is created, any commission that was associated with the document that was partially paid (Document #201 in the example above) will be carried forward to the balance forward document. This commission will be paid when the balance forward document is purged on a subsequent run of Fully paid open items.

For an open item customer, the software purges fully paid documents as follows:

| • | All the documents with the same apply-to number, whose document date is on or before the cut-off date, are considered. If the net sum of these documents is zero, then all of the documents for that apply-to number are purged. |

| • | Payments dated after the cut-off date are not considered during the purge, so that an invoice dated prior to the cut-off date will be purged only if the payment that applies to it is also within the date range. |

| • | Also, if the credits that apply to an invoice are greater than the invoice debit amount, the invoice will not be purged. |

In other words, unless the credits applied to an invoice equal the total of an invoice exactly, neither will be purged.

If you do not employ sales representatives, or if you do not pay them on commission, this section does not apply to you.

If your commissions become payable when goods are sold (rather than when they are paid for), you should likewise skip this section.

All three of these points are determined by your entries in A/R Control information. See the Use commissions field and the commissions related fields following that one.

Open items are considered to be fully paid at the time they are purged. Therefore, it is normally at this point that commissions are calculated.

For each purged open item with a commission amount:

| • | The sales rep’s period-to-date and year-to-date commission amounts are updated. |

| • | The commission amounts in the customer’s period-to-date and year-to-date fields are updated. |

| • | Commission due information is stored for the document. This information will appear on the Commissions Due report. |

If you do not usually purge invoices until some time after they are paid, you may not want your sales representatives to wait for the purge before they can get their commission. To pay commissions in advance of the purge, see the discussion on field Log commission due for open item customer. As the field name implies, this can only be done for open item customers.

The payment date for the commission is whatever date you enter in the Thru what date field.

Select

Fully paid open items from the Reports, general menu.

You may also access this via Purge from the Open items menu.

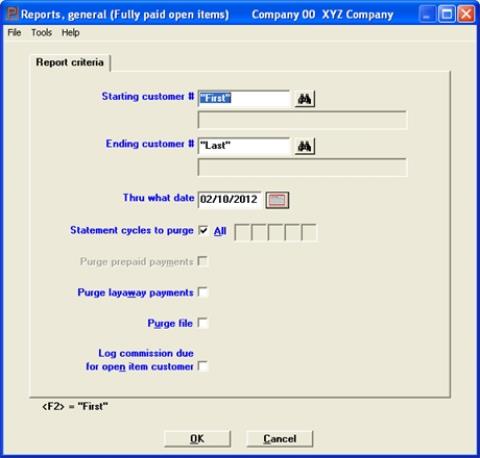

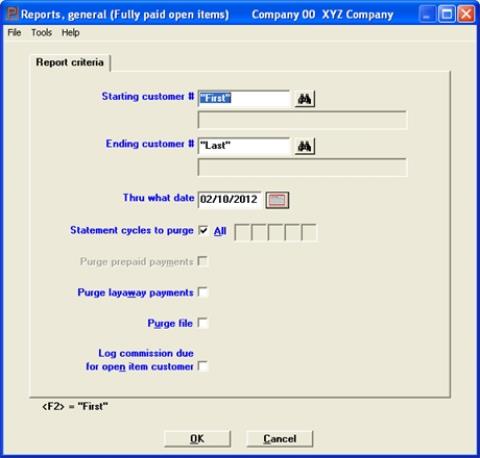

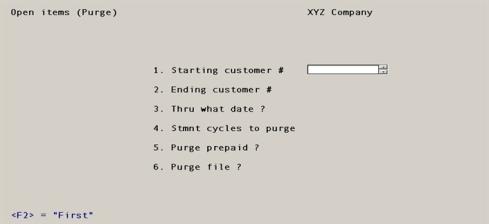

The following screen appears:

Graphical Mode

Character Mode

Enter the following information:

Starting customer # and

Ending customer #

Enter the range of customer numbers for which fully paid documents are to be included in the purge, or use the option:

Options

|

<F2> |

For the First starting customer number or Last ending |

|

Format |

12 characters |

|

Example |

Type 50 in the starting field and 300 in the ending field. |

This is the last date for which paid open items will be considered for purging. All open items dated after the entered date will remain, whether or not they are fully paid. When paying commissions on payments, the commission amounts are posted to Commissions Due with this date.

Enter a date. The default is the current system date.

|

Format |

MMDDYY |

|

Example |

Press <Enter> |

Enter up to five statement cycle codes. Only those customers having codes matching these will have their paid A/R open items purged.

|

<F5> |

For All statement cycle codes |

In the first subfield, you may use the option:

|

Format |

One letter in each of five subfields. If you have fewer than five, enter a blank in the next subfield. |

|

Example |

Press <F5> |

This field will display as (Not applicable) if the A/R Control information Process prepaid cash field is unchecked ( entered as N).

A fully applied prepaid items means it has a matching positive and negative amount in Open Items.

If you are checking the box or entering Y on the Purge file field you may check this box to have fully applied prepaid deposit amounts removed from A/R Open Items. Leave it unchecked if you want to retain the fully applied prepaid deposit amounts in Open Items.

If you are leaving it unchecked or entering N on the Purge file field you may check this box to have the fully applied prepaid deposit amounts printed on the purge report. Leave it unchecked if you do not want to print the prepaid deposit amounts on the report.

Prepaid deposits are converted to a payment type when applied to and posted with an invoice. They are not retained historically following a purge.

|

Format |

Graphical: Check box, where checked is Yes and unchecked is No Character: One letter, either Y or N. The default is N. |

|

Example |

Answer Y |

If you need to purge a prepayment that has not been applied to an invoice, enter a matching prepayment amount to the same customer with the same check number and date as the original prepayment, but with a negative amount. If the original prepayment amount was $400, then enter the prepayment as -$400. The both the positive and negative prepayment will purge.

This field cannot be entered if Point of Sale is not installed on your system.

Layaway payments will only purge if there is a matching positive and negative layaway amounts in Open Items.

If you are entering Y on the Purge file field you may select Y to have layaway payment amounts removed from A/R Open Items. Answer N if you want to retain the layaway payment amounts in Open Items.

If you are entering N on the Purge file field you may select Y to have layaway payment amounts printed on the purge report. Answer N if you do not want to print the layaway payment amounts on the report.

Layaway payments are converted to a payment type in Open Items when applied to and posted with an invoice from Point of Sale. They are not retained historically following a purge. However layaway payments are retained with Point of Sale invoice history.

|

Format |

Graphical: Check box, where checked is Yes and unchecked is No Character: One letter, either Y or N. The default is N. |

|

Example |

Answer Y |

Check the box or enter Y if you want to have the fully paid items removed from A/R Open Items and to print the Purge Report. Leave the box unchecked or enter N if you want the report only, without purging the data.

Purged open items are transferred to Customer History (provided Keep customer history has been checked in Control information), and is then available for reviewing or reporting through Customer history.

|

Format |

Graphical: Check box, where checked is Yes and unchecked is No Character: One letter, either Y or N. The default is N. |

|

Example |

Answer Y |

Log commission due for open item customer

This may only be entered if:

| • | Commissions are paid upon payment (per A/R Control information), and |

| • | You unchecked the box (answered No) to the Purge file question above. |

Check the box (answer Yes) if you wish commissions due to sales reps based on fully paid invoices (for open item customers) to be logged prior to purging Open Items. This allows you to pay your sales representatives their commissions and still leave the invoices on file.

For open item customers, you may no longer change the apply-to number for the open item once you do this. This is because by paying the commission you are saying that the invoice is fully paid. Thus, the apply-to numbers cannot be changed because the invoice would then not really be fully paid.

If the customer later wants a credit for returned goods related to an invoice for which you have logged the commission in this fashion, then you have to issue a credit memo (which will result in a negative commission amount to reduce the sales rep’s commission).

You are informed that only open item customers will be processed, and that commissions due to sales reps for fully paid open items will be logged and that the open items will not be purged. Answer Y if you are sure you want to do this.

Commissions due upon payment for balance-forward customers can only be logged when Open Items are purged.

|

Format |

Graphical: Check box, where checked is Yes and unchecked is No Character: One letter, either Y or N. The default is N. |

|

Example |

(This field does not appear in this example, as commissions are paid on sales) |

Make any needed changes, then press <Enter> to process the file.

If you checked the box for the Purge file field, you are asked if you are sure you wish to purge. Answer Yes or No as appropriate.

An A/R Open Item Purge Report is printed. If you chose to purge, this report may not be displayed and it may not be printed to PDF. Purging makes it an audit trail report and audit trail reports have this restriction.

A sample A/R Open Item File Purge Report is in the Sample Reports appendix.